- Get link

- X

- Other Apps

|

| Relaxo Footwear |

About the company

- Relaxo Footwear is the largest footwear manufacturer in India, nobody in the country has a similar scale which Relaxo has. They have a big competitive advantage and lead in the "affordable" segment of the footwear industry. Their numbers speak for the company, Sales have grown by 30% and profits by 14% each year in the past decade.

BUT,

- The past year wasn't that great for the company. Their revenue in Q2 FY23 was down by 10.4%, gross margins were down by 793 bps (lowest for the company in the past decade), EBITDA margins were down 1290 bps because raw material prices were volatile as hell. Even the stock price tanked more than 40%..!

WHY DID IT HAPPEN?

- This was due to underwhelming sales and price cuts as people switched to cheaper options as a result of high inflation.

- According to the managing director of Relaxo Footwear, Mr. Ramesh Kumar Dua, affordability has been impacted in a big percent of their business. Rural market of India is severely impacted and is struggling badly. The purchasing power there has deteriorated more than urban areas.

- Inflation is one of the biggest reasons behind the company's fall, as it simply kills demand which not only leads to less sales but also forces the company to lower down prices so that they can revive some demand back. This inflation affected country's rural areas the most which is a huge market for Relaxo as they focus on the "affordable" part of the footwear industry.

|

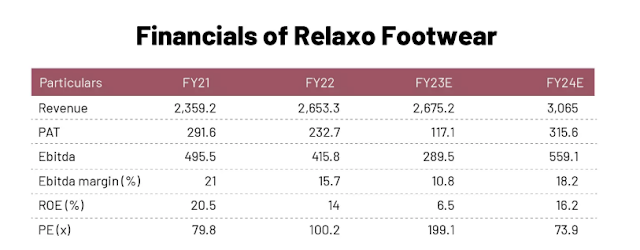

| Relaxo financials |

Latest Quarter

- In Q2FY23, the company's performance fell to its worst since the past 10 quarters, Net profit declined 67.3% yoy, revenue declined 6.27% yoy, cost of good sold went up 25% yoy and operating expenses went up by 2.11% yoy

- This was a result of price cuts, low demand, labor shortages and rocket raw material prices (35% of raw material are derivates of crude) during the same period. Relaxo was the worst hit among its peers as their major market resides in rural part of India, the tier-3 towns who were in turn worst hit by sky touching inflation.

- Management says margins might further deteriorate in the next quarter which is Q3FY23.

Comments

Post a Comment